Freqtrade 是一个用 Python 编写的免费开源加密货币交易机器人。它旨在支持所有主要交易所并通过 Telegram 或 webUI 进行控制。功能包含回测、绘图和资金管理工具以及通过机器学习的策略优化。

目前支持的交易所:

特性:

- 基于 Python 3.8+:适用于任何操作系统 – Windows、macOS 和 Linux。

- 持久性:持久性是通过 sqlite 实现的。

- Dry-run:不花钱运行机器人。

- 回测:模拟买入/卖出策略。

- 通过机器学习进行策略优化:使用机器学习通过真实的交易所数据优化买入/卖出策略参数。

- 边缘头寸规模计算您的胜率、风险回报率、最佳止损位并在为每个特定市场建立头寸之前调整头寸规模。

- 白名单加密货币:选择你要交易的加密货币或使用动态白名单。

- 黑名单加密货币:选择你想要避免的加密货币。

- 内置 WebUI:内置 Web UI 来管理你的机器人。

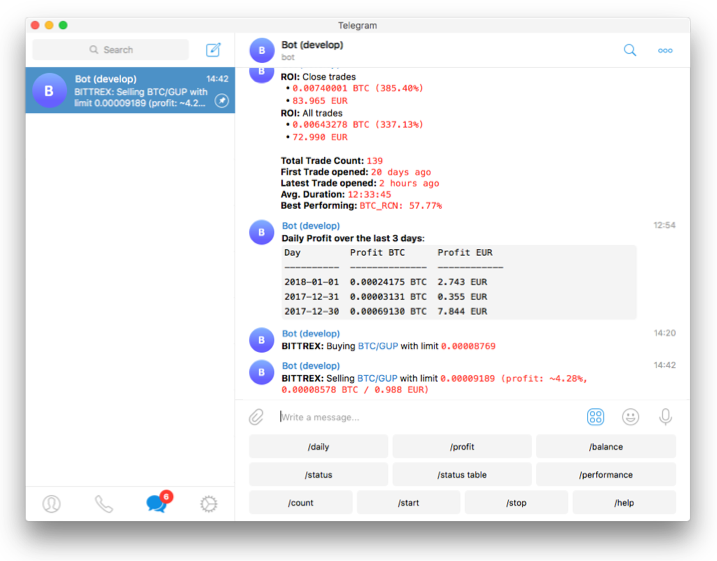

- 可通过 Telegram管理:使用 Telegram 管理机器人。

- 以法定货币显示盈亏:以法定货币显示你的盈亏。

- 表现状态报告:提供你当前交易的表现状态。

1.准备

开始之前,你要确保Python和pip已经成功安装在电脑上,如果没有,请访问这篇文章:超详细Python安装指南 进行安装。

(可选1) 如果你用Python的目的是数据分析,可以直接安装Anaconda:Python数据分析与挖掘好帮手—Anaconda,它内置了Python和pip.

(可选2) 此外,推荐大家用VSCode编辑器来编写小型Python项目:Python 编程的最好搭档—VSCode 详细指南

在Linux/MacOS下,三行命令就能完成安装:

git clone -b develop https://github.com/freqtrade/freqtrade.git cd freqtrade ./setup.sh --install

如果你无法克隆此项目,请在Python实用宝典公众号后台回复:freqtrade 下载。

Windows环境下打开Cmd(开始—运行—CMD),输入命令安装依赖:

git clone https://github.com/freqtrade/freqtrade.git cd freqtrade # 安装ta-lib pip install build_helpers/TA_Lib-0.4.24-cp38-cp38-win_amd64.whl pip install -r requirements.txt pip install -e . freqtrade

请注意,此处安装ta-lib时项目方提供了python3.8/3.9/3.10,其他Python版本请自行搜索下载。

输入freqtrade时,显示以下信息说明安装成功:

(freqtrade) D:\CODE\trader\freqtrade>freqtrade 2022-02-17 19:40:50,174 - freqtrade - ERROR - Usage of Freqtrade requires a subcommand to be specified. To have the bot executing trades in live/dry-run modes, depending on the value of the `dry_run` setting in the config, run Freqtrade as `freqtrade trade [options...]`. To see the full list of options available, please use `freqtrade --help` or `freqtrade <command> --help`.

2.Freqtrade 快速开始

下面教你如何开发一个简单的交易策略。

一个策略文件往往包含这些东西:

- 指标

- 购买规则

- 卖出规则

- 建议最低投资回报率

- 强烈推荐止损

Freqtrade使用 Pandas 作为基础数据结构,它底层的OHLCV都是以Dataframe的格式存储的。

Dataframe数据流中每一行数据代表图表上的一根K线,最新的K线始终是数据库中最后一根。

> dataframe.head()

date open high low close volume

0 2021-11-09 23:25:00+00:00 67279.67 67321.84 67255.01 67300.97 44.62253

1 2021-11-09 23:30:00+00:00 67300.97 67301.34 67183.03 67187.01 61.38076

2 2021-11-09 23:35:00+00:00 67187.02 67187.02 67031.93 67123.81 113.42728

3 2021-11-09 23:40:00+00:00 67123.80 67222.40 67080.33 67160.48 78.96008

4 2021-11-09 23:45:00+00:00 67160.48 67160.48 66901.26 66943.37 111.39292Pandas 提供了计算指标的快速方法。为了从这种速度中受益,建议不要使用循环,而是使用矢量化方法。

矢量化操作在整个数据范围内执行计算,因此,与遍历每一行相比,在计算指标时要快得多。

dataframe.loc[(dataframe['rsi'] > 30), 'buy'] = 1

类似于上面这样的赋值方法,会自动设置rsi大于30的数据的buy列的值为1。

买入规则

def populate_buy_trend(self, dataframe: DataFrame, metadata: dict) -> DataFrame:

"""

Based on TA indicators, populates the buy signal for the given dataframe

:param dataframe: DataFrame populated with indicators

:param metadata: Additional information, like the currently traded pair

:return: DataFrame with buy column

"""

dataframe.loc[

(

(qtpylib.crossed_above(dataframe['rsi'], 30)) & # Signal: RSI crosses above 30

(dataframe['tema'] <= dataframe['bb_middleband']) & # Guard

(dataframe['tema'] > dataframe['tema'].shift(1)) & # Guard

(dataframe['volume'] > 0) # Make sure Volume is not 0

),

'buy'] = 1

return dataframe请注意,一定要不修改并返回”open”, “high”, “low”, “close”, “volume”列,这些是基础行情数据,如果返回错误的数据将可能会导致一些奇怪数据的产生。

如上所示的方法中,符合条件的数据的buy值会被设为1代表买入,否则为0或nan值。

卖出规则

def populate_sell_trend(self, dataframe: DataFrame, metadata: dict) -> DataFrame:

"""

Based on TA indicators, populates the sell signal for the given dataframe

:param dataframe: DataFrame populated with indicators

:param metadata: Additional information, like the currently traded pair

:return: DataFrame with buy column

"""

dataframe.loc[

(

(qtpylib.crossed_above(dataframe['rsi'], 70)) & # Signal: RSI crosses above 70

(dataframe['tema'] > dataframe['bb_middleband']) & # Guard

(dataframe['tema'] < dataframe['tema'].shift(1)) & # Guard

(dataframe['volume'] > 0) # Make sure Volume is not 0

),

'sell'] = 1

return dataframe与买入类似,这里不赘述了。

最小投资回报率

在类中增加这个初始化变量,能控制投资回报率:

minimal_roi = {

"40": 0.0,

"30": 0.01,

"20": 0.02,

"0": 0.04

}上述配置意味着:

- 只要达到 4% 的利润就卖出

- 达到 2% 利润时卖出(20 分钟后生效)

- 达到 1% 利润时卖出(30 分钟后生效)

- 交易未亏损时卖出(40 分钟后生效)

此处的计算包含费用。

要完全禁用 ROI,请将其设置为一个非常高的数字:

minimal_roi = {

"0": 100

}虽然从技术上讲并没有完全禁用,但一旦交易达到 10000% 利润,它就会卖出。

止损

强烈建议设置止损,以保护资金免受不利的剧烈波动。

设置 10% 止损的示例:

stoploss = -0.10

一个完整代码如下:

# pragma pylint: disable=missing-docstring, invalid-name, pointless-string-statement

# flake8: noqa: F401

# isort: skip_file

# --- Do not remove these libs ---

from re import A

import numpy as np # noqa

import pandas as pd # noqa

from pandas import DataFrame

from freqtrade.strategy import (BooleanParameter, CategoricalParameter, DecimalParameter,

IStrategy, IntParameter)

# --------------------------------

# 你自己所需要的模块放在这里

import talib.abstract as ta

import freqtrade.vendor.qtpylib.indicators as qtpylib

# This class is a sample. Feel free to customize it.

class SampleStrategy(IStrategy):

"""

This is a sample strategy to inspire you.

More information in https://www.freqtrade.io/en/latest/strategy-customization/

You can:

:return: a Dataframe with all mandatory indicators for the strategies

- Rename the class name (Do not forget to update class_name)

- Add any methods you want to build your strategy

- Add any lib you need to build your strategy

You must keep:

- the lib in the section "Do not remove these libs"

- the methods: populate_indicators, populate_buy_trend, populate_sell_trend

You should keep:

- timeframe, minimal_roi, stoploss, trailing_*

"""

# Strategy interface version - allow new iterations of the strategy interface.

# Check the documentation or the Sample strategy to get the latest version.

INTERFACE_VERSION = 2

# 设定最小投资回报

minimal_roi = {

"60": 0.01,

"30": 0.02,

"0": 0.04

}

# 止损

stoploss = -0.10

# 指标参数

buy_rsi = IntParameter(low=1, high=50, default=30, space='buy', optimize=True, load=True)

sell_rsi = IntParameter(low=50, high=100, default=70, space='sell', optimize=True, load=True)

# K线时间

timeframe = '5m'

# 在新K线出现时执行

process_only_new_candles = False

# These values can be overridden in the "ask_strategy" section in the config.

use_sell_signal = True

sell_profit_only = False

ignore_roi_if_buy_signal = False

# 预准备K线数

startup_candle_count: int = 30

# 下单类型

order_types = {

'buy': 'limit',

'sell': 'limit',

'stoploss': 'market',

'stoploss_on_exchange': False

}

# 订单有效时间(gtc: 除非取消否则一直有效)

order_time_in_force = {

'buy': 'gtc',

'sell': 'gtc'

}

plot_config = {

'main_plot': {

'tema': {},

'sar': {'color': 'white'},

},

'subplots': {

"MACD": {

'macd': {'color': 'blue'},

'macdsignal': {'color': 'orange'},

},

"RSI": {

'rsi': {'color': 'red'},

}

}

}

def informative_pairs(self):

"""

Define additional, informative pair/interval combinations to be cached from the exchange.

These pair/interval combinations are non-tradeable, unless they are part

of the whitelist as well.

For more information, please consult the documentation

:return: List of tuples in the format (pair, interval)

Sample: return [("ETH/USDT", "5m"),

("BTC/USDT", "15m"),

]

"""

return []

def populate_indicators(self, dataframe: DataFrame, metadata: dict) -> DataFrame:

"""

Adds several different TA indicators to the given DataFrame

Performance Note: For the best performance be frugal on the number of indicators

you are using. Let uncomment only the indicator you are using in your strategies

or your hyperopt configuration, otherwise you will waste your memory and CPU usage.

:param dataframe: Dataframe with data from the exchange

:param metadata: Additional information, like the currently traded pair

:return: a Dataframe with all mandatory indicators for the strategies

"""

# Momentum Indicators

# ------------------------------------

dataframe['adx'] = ta.ADX(dataframe)

dataframe['rsi'] = ta.RSI(dataframe)

stoch_fast = ta.STOCHF(dataframe)

dataframe['fastd'] = stoch_fast['fastd']

dataframe['fastk'] = stoch_fast['fastk']

# MACD

macd = ta.MACD(dataframe)

dataframe['macd'] = macd['macd']

dataframe['macdsignal'] = macd['macdsignal']

dataframe['macdhist'] = macd['macdhist']

# MFI

dataframe['mfi'] = ta.MFI(dataframe)

# Bollinger Bands

bollinger = qtpylib.bollinger_bands(qtpylib.typical_price(dataframe), window=20, stds=2)

dataframe['bb_lowerband'] = bollinger['lower']

dataframe['bb_middleband'] = bollinger['mid']

dataframe['bb_upperband'] = bollinger['upper']

dataframe["bb_percent"] = (

(dataframe["close"] - dataframe["bb_lowerband"]) /

(dataframe["bb_upperband"] - dataframe["bb_lowerband"])

)

dataframe["bb_width"] = (

(dataframe["bb_upperband"] - dataframe["bb_lowerband"]) / dataframe["bb_middleband"]

)

# Parabolic SAR

dataframe['sar'] = ta.SAR(dataframe)

# TEMA - Triple Exponential Moving Average

dataframe['tema'] = ta.TEMA(dataframe, timeperiod=9)

hilbert = ta.HT_SINE(dataframe)

dataframe['htsine'] = hilbert['sine']

dataframe['htleadsine'] = hilbert['leadsine']

return dataframe

def populate_buy_trend(self, dataframe: DataFrame, metadata: dict) -> DataFrame:

"""

Based on TA indicators, populates the buy signal for the given dataframe

:param dataframe: DataFrame populated with indicators

:param metadata: Additional information, like the currently traded pair

:return: DataFrame with buy column

"""

dataframe.loc[

(

# Signal: RSI crosses above 30

(qtpylib.crossed_above(dataframe['rsi'], self.buy_rsi.value)) &

(dataframe['tema'] <= dataframe['bb_middleband']) & # Guard: tema below BB middle

(dataframe['tema'] > dataframe['tema'].shift(1)) & # Guard: tema is raising

(dataframe['volume'] > 0) # Make sure Volume is not 0

), 'buy'] = 1

return dataframe

def populate_sell_trend(self, dataframe: DataFrame, metadata: dict) -> DataFrame:

"""

Based on TA indicators, populates the sell signal for the given dataframe

:param dataframe: DataFrame populated with indicators

:param metadata: Additional information, like the currently traded pair

:return: DataFrame with sell column

"""

dataframe.loc[

(

# Signal: RSI crosses above 70

(qtpylib.crossed_above(dataframe['rsi'], self.sell_rsi.value)) &

(dataframe['tema'] > dataframe['bb_middleband']) & # Guard: tema above BB middle

(dataframe['tema'] < dataframe['tema'].shift(1)) & # Guard: tema is falling

(dataframe['volume'] > 0) # Make sure Volume is not 0

), 'sell'] = 1

return dataframe

3.启动机器人

启动机器人前还需要设定配置,配置模板在 config/examples 下面。

比如币安的配置,你还需要输入key和secret:

"exchange": {

"name": "binance",

"key": "your_exchange_key",

"secret": "your_exchange_secret",

......

}

}启动机器人:

freqtrade trade --strategy AwesomeStrategy --strategy-path /some/directory -c path/far/far/away/config.json

–strategy-path 指定策略文件位置

-c 参数指定配置文件位置

比如我把策略放在了user_data/strategies下,配置放在了config_examples下,这么输入命令启动机器人即可:

freqtrade trade --strategy SampleStrategy --strategy-path user_data/strategies -c config_examples/config_binance.example.json

由于篇幅问题,本文只是介绍了freqtrade的冰山一角,在启动机器人前,一定要进行回测并进行模拟交易。它还有TG通知功能、WebUI管理界面,详细的使用方法大家可以参考官方教程:

https://www.freqtrade.io/en/stable/

我们的文章到此就结束啦,如果你喜欢今天的 Python 教程,请持续关注Python实用宝典。

有任何问题,可以在公众号后台回复:加群,回答相应验证信息,进入互助群询问。

原创不易,希望你能在下面点个赞和在看支持我继续创作,谢谢!

Python实用宝典 ( pythondict.com )

不只是一个宝典

欢迎关注公众号:Python实用宝典

评论(0)